About COI

At UC Riverside (UCR), the Research Compliance supports the Conflict of Interest (COI) Committee, which advises the Vice Chancellor for Research and Economic Development (VC-RED). Together, they ensure that research conducted at UCR is designed, conducted, and reported objectively—free from bias and aligned with the highest ethical standards.

The COI team acts as a central liaison among faculty, staff, sponsors, and administrative offices to facilitate the disclosure, review, and management of real or perceived conflicts of interest in research.

As part of the University of California system, UCR adheres to system wide policies addressing financial conflicts of interest, including compliance with State of California and Federal regulations. These policies promote research integrity while supporting the University’s mission to transform lives through discovery, communication, translation, application, and preservation of knowledge.

|

|

|

What is a Conflict of Interest?

A COI is when an Outside Interest is related to an investigator’s institutional responsibilities and could or may appear to affect the design directly and significantly, conduct, or reporting of research.

Outside financial interests should be reported in Kuali per the research sponsors regulation. Outside financial interests are any financial interests and other personal interests or relationships with an external entity that are related to an investigator’s institutional responsibilities. These financial interests include but are not limited to income, travel, equity, intellectual property rights. Positions constitute an outside financial interest whether paid or unpaid. Financial interests and positions of immediate family members are included in outside financial interests.

When investigators share their financial interests per the research sponsors regulation, this assists in promoting transparency and accountability, financial disclosures also protect the researcher’s interests by 1) meeting the requirements set by sponsors and the University, 2) having the COI committee, an objective third party, review the financial interests and the research, and 3) demonstrating a commitment to scientific integrity.

How to Disclose Outside Financial Interests

All investigators must submit their financial disclosures to Kuali COI. Kuali is an interactive online form that requests financial interest information based on the research sponsor’s regulations including State, Public Health Service (PHS), Department of Energy (DOE), National Science Foundation (NSF), and National Aeronautics and Space Administration (NASA). You can find the following forms in Kuali COI.

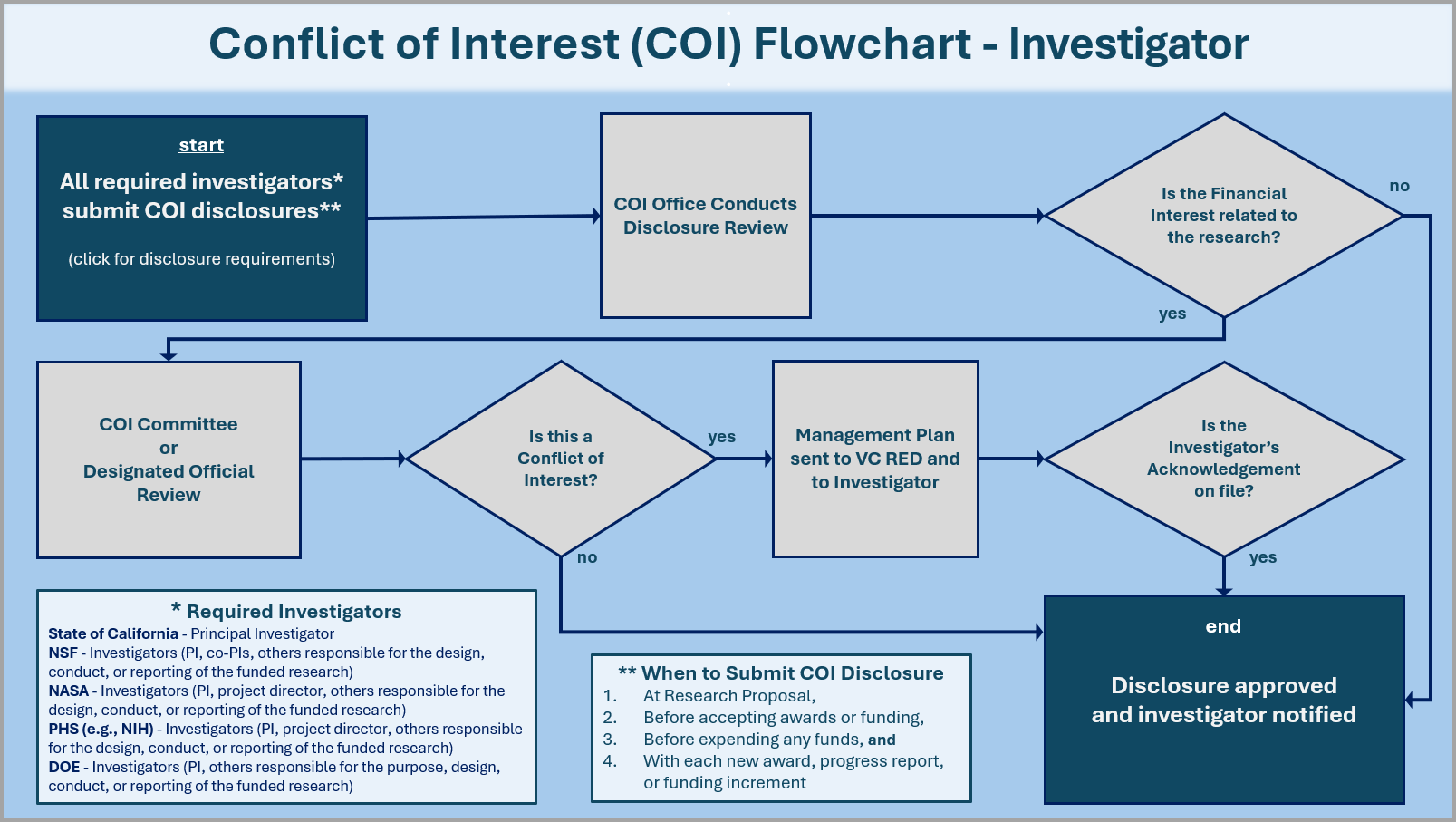

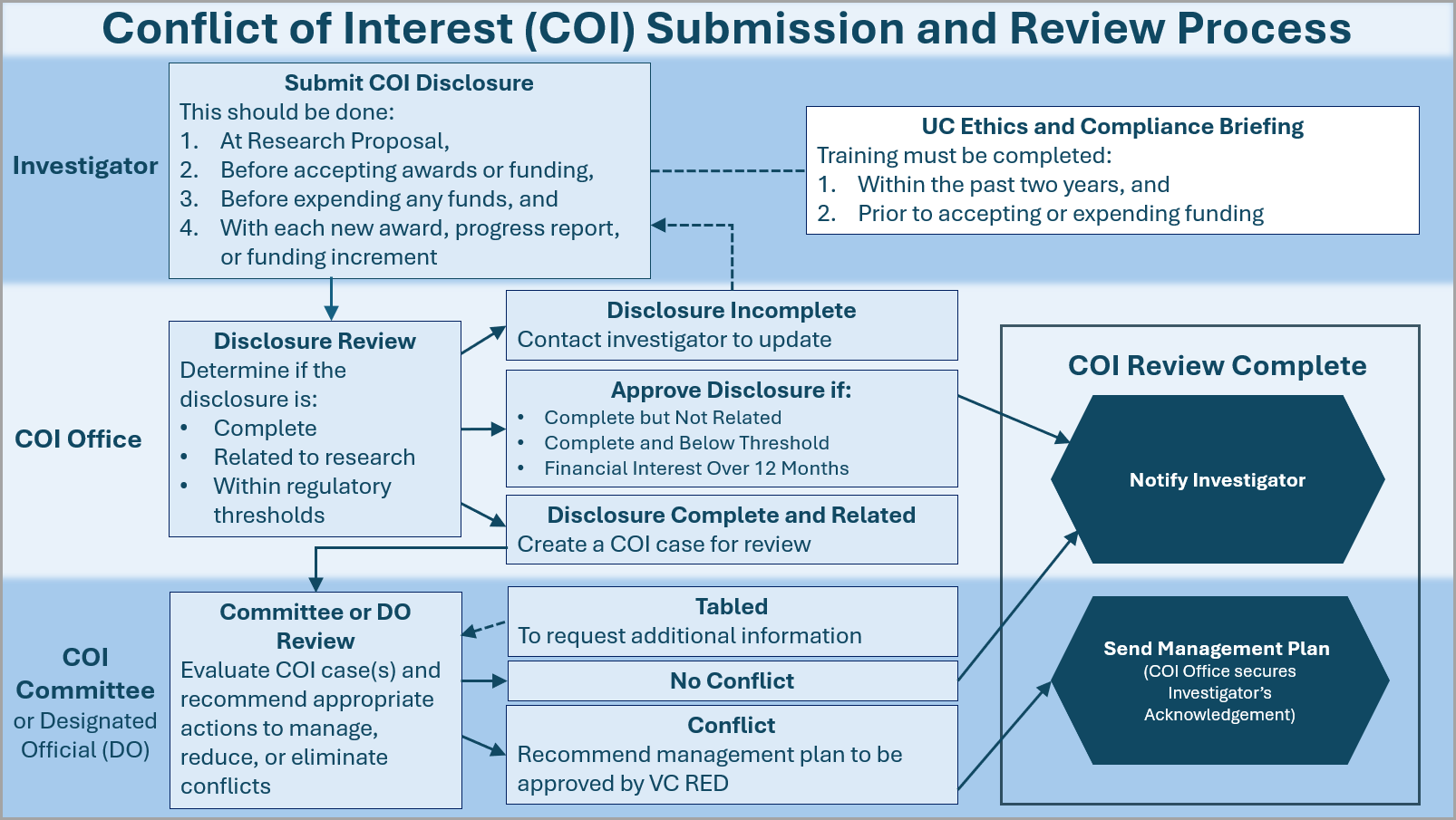

What is the COI Review Process?

ORC staff are the initial reviewers of disclosure forms submitted to Kuali COI. Should the staff find that an investigator’s financial interest is related to their research, they then route the disclosure forms to the COI Committee. The COI committee reviews the financial interest in conjunction to the investigator’s research at their monthly meeting. If the COI committee determines that the financial interest is a conflict of interest meaning the financial interest could directly and significantly affect the design, conduct, reporting, or purpose of the research, the committee then recommends an adequate management and monitoring plan to be approved by the Vice Chancellor for Research and Economic Development (VC-RED).

Regulatory Requirements

There are currently five regulatory requirements that the University currently reviews and reports. This section includes an overview of the reporting triggers, list of investigators responsible for disclosing financial interests, when investigators should disclose their financial interests, and if training is required.

-

UC Riverside Conflict of Interest Disclosure Chart

Investigators must disclose their financial interests received within the 12 months prior to disclosure submission including the financial interests of their immediate family member. All disclosures must be approved prior to acceptance of the award or additional funding, and/or to expenditure of funds.

STATE LAW

NATIONAL SCIENCE FOUNDATION and NATIONAL AERONAUTICS & SPACE ADMINISTRATION

PUBLIC HEALTH SERVICE and DEPARTMENT OF ENERGY

Reporting Triggers

- Research contract/grant from a non‐governmental entity as the prime and/or direct sponsor.

- Research Gifts earmarked for a specific individual or specific research project.

- Material Transfer Agreement

- NSF research contracts and grants

- NASA research contract and cooperative agreements

- Non‐governmental entity which flows down NSF/NASA funds (including SBIR/STTR subawards)

- California Institute for Regenerative Medicine (CIRM) Grant, Juvenile Diabetes Research Foundation (JDRF) Grant

- UC Special Research Programs (HIV/AIDS, breast cancer and tobacco related disease)

- PHS grant, cooperative agreement, contract, or DOE financial assistance award (e.g., grant, cooperative agreement, or technology investment agreement)

- Non‐governmental entity which flows down PHS/DOE funds

- Research Funding from organizations that follow PHS/DOE disclosure requirements (i.e., American Cancer Society, American Heart Association). Complete list here.

Exclusions

- All exempt sponsors: FPPC exempt list

- All non-profit, tax-exempt educational institutions. However, researchers must disclose for the prime sponsor if the educational institution received funding from a non-governmental entity.

N/A

- SBIR Phase I or STTR Phase I award

- Office of Indian Energy

Who

- All persons employed by UC who have principal responsibility for a research project if the project is to be funded or supported, in whole or in part, by a contract or grant (or other funds earmarked by the donor for a specific researcher) from a non-governmental entity.

- All persons employed by UC who have principal responsibility for a research project if the project is to be funded or supported, in whole or in part, by a gift (earmarked by the donor for a specific researcher) from a non-governmental entity.

All investigators responsible for the “design, conduct or reporting” of the NSF-funded research project or educational activities to disclose their significant financial interests related to the research project or educational activities. Investigators must also disclose the financial interests of their spouses/registered domestic partners and dependent children. UCR’s policy is consistent with the “Investigator Financial Disclosure Policy” of the NSF.

All individuals "with responsibility for the design, conduct, reporting, or purpose1 of the research" must disclose the “significant” and “related” financial or management interests to the research described in the proposal for themselves, their spouses/registered domestic partners, and their dependent children.

What to Disclose

A financial interest in the non‐governmental sponsor of the research including:

- Income ≥ $500

- Investments ≥ $2,000

- Director, Officer, Employee, Partner, Trustee, Consultant or Management position

- Loan Balances ≥$500

- Personal Gifts Valued at ≥ $50

- Travel Reimbursements

- With the initial award

- With renewal award (additional funding intended to extend or results in the extension of a project beyond the originally approved project period)

A significant financial interest related to the research project including:

- Salary, honoraria, royalties, venture or other capital financing, or other payments > $10,000 (excluding income from seminars, lectures, teaching engagements, or service on advisory committees or review panels for public or nonprofit entities)

- Equity interest2 > $10,000 or 5% ownership interest

- Intellectual Property interest in a patent, patent application, or copyright of a software (excluding intellectual property owned by the UC.)

- With the initial proposal

- When a new Investigator(s) is added

- With any change in an investigator’s financial interest

A significant financial interest related to the Investigator’s institutional responsibilities including:

- If publicly traded entity, total value of compensation and equity interest2 > $5,000

- If non‐publicly traded entity, total value of compensation > $5,000 or any equity interest2

- Income received related to intellectual property > $5,000 (excluding intellectual property owned by the UC.)

- Any reimbursed or sponsored travel (excluding (1) travel that is reimbursed or sponsored by a US Federal, state, local government agency, a domestic Institution of higher education, or a research institute affiliated with an Institution of higher education within US (for PHS only- also exclude an academic teaching hospital, a medical center); and (2) sponsored or reimbursed travel for the Investigator’s spouse/registered domestic partner and/or dependent children.

- With the initial and renewal proposals

- With supplemental funding proposal

- With non‐competing continuation

- With no cost time extension

- When a new Investigator(s) is added

- At least annually for duration of project

- With any new significant financial interest (New significant financial interests must be reported within 30 days of acquiring or discovering the new SFI.)

Forms

- All investigators must submit their financial disclosures to Kuali COI.

- You can find the forms in Kuali COI.

- All investigators must submit their financial disclosures to Kuali COI.

- You can find the forms in Kuali COI.

- All investigators must submit their financial disclosures to Kuali COI.

- You can find the forms in Kuali COI.

Training

All extramurally funded researchers are required to complete the UC Ethics and Compliance Briefing for Researchers (ECBR) training, as mandated by UC Office of the President (UCOP). This requirement applies to all funding sponsors including PHS and DOE, and must be renewed every two years.

All extramurally funded researchers are required to complete the UC Ethics and Compliance Briefing for Researchers (ECBR) training, as mandated by UC Office of the President (UCOP). This requirement applies to all funding sponsors including PHS and DOE, and must be renewed every two years.

All extramurally funded researchers are required to complete the UC Ethics and Compliance Briefing for Researchers (ECBR) training, as mandated by UC Office of the President (UCOP). This requirement applies to all funding sponsors including PHS and DOE, and must be renewed every two years.

Footnotes: [1] DOE only. [2] “Equity interest” includes stock, stock options, private equity, and other ownership interests. (Updated: May 2024)

Contact Us

If you have questions, the Office of Research Compliance recommends you consult and engage our office as soon as possible.

Please email us at coi@ucr.edu to set up an appointment.

-

Conflict of Interest

Q: How are Research-Related Conflicts of Interest (COI) and Conflicts of Commitment (COC) related?

A: Both COI and COC may involve an Investigator’s outside financial interests and institutional responsibilities, but they are managed separately on campus under different offices, policies, and procedures.- Research-Related COI:

Occurs when an investigator’s outside financial interests or obligations—such as salaries, consulting fees, equity ownership, intellectual property income, gifts, loans, travel payments, or roles like director or consultant—could bias or appear to bias a research project. This includes interests held by the investigator’s immediate family. Contact the COI office for more information. - Conflict of Commitment:

The UC Regents require that faculty not allow outside activities to interfere with primary University duties. Relevant policies are APM 025 (general campus faculty) and APM 671 (Health Sciences Compensation Plan), both of which set limits on outside professional activities.

To comply, UCR faculty must:- Obtain Prior Approval for applicable outside activities/li>

- Submit an Annual Report

For details, see the Office of Academic Personnel’s COC page.

Q: What are some examples of mitigation or management strategies for COIs?

A: COIs can be managed, reduced, or eliminated through measures such as:- Public disclosure of significant financial interests

- Training in research-related COI for all research personnel

- independent monitoring of research

- Using randomized or double-blind study designs

- Modifying the research plan to ensure objectivity

- Stepping down as principal investigator

- Restricting involvement in parts of the research

- Divesting the financial interest

- Ending relationships that create the conflict

Q: My disclosure will be sent to COI for review. When will I receive the results so my study funds can be released?

A: Reviews typically take four to six weeks, depending on the nature of the disclosure. ORC staff will contact you if additional review is needed. - Research-Related COI:

-

Founding or Advising a Company

Q: What general principles should I keep in mind when starting a company?

A:- Keep your company activities separate from UC research and administrative duties.

- Your company will be treated the same as any external company.

- Always disclose potential conflicts so COI can assess and mitigate risk.

- Many research-related conflicts are manageable, not prohibited.

- Human-subjects research receives heightened COI review.

- Conflicts must be evaluated on a case by case basis.

- When unsure, disclose it to COI.

- Using a non-conflicted investigator and study blinding may help, but COI must still review the situation.

Q: Can I start a company?

A: Yes. UCR’s conflict of interest (COI) and conflict of commitment (COC) policies do not prohibit investigators from forming companies. However, disclosures and approvals may be required. For entrepreneurial resources, visit UCR’s EPIC (Entrepreneurial Proof of Concept and Innovation Center).Q: Can I serve on a board of directors?

A: Serving on a Board of Directors, Advisory Board, or similar entity is not prohibited.- If the role includes financial interests (e.g., equity, compensation), COI disclosure may be required.

- If the COI Committee determines a conflict exists in relation to your research, management steps may be required.

- Board service carries fiduciary—not operational—responsibility, so it is permissible.

- Your primary professional commitment must remain with the University. More on COC is available on the Conflict of Commitment and Outside Professional Activities page.

Q: Can I serve on a scientific advisory board?

A: Serving in this capacity in permitted, as these roles do not imply management responsibility.- You must recuse yourself from decisions involving funding of your own research.

- If financial interests are involved, COI disclosure may be required.

Q: I consult for a company that wants to fund my UCR lab through an industry-sponsored research agreement. Is this allowed?

A: Strategies and review factors include:- Use a non conflicted investigator and/or blind the study.

- COI will assess issues such as:

- Who supervises research personnel.

- Whether any personnel report to the conflicted researcher.

- Whether a non conflicted investigator reports to the conflicted individual.

- Whether students are involved and who supervises them.

- Who oversees data collection, analysis, and reporting.

- Whether human subjects are involved.

- Additional measures may be required depending on the level of risk and study design.

Q: I am a co-founder of a company that wants to fund my UCR lab through an industry-sponsored research agreement. Is this allowed? What should I be concerned about?

A: Some important safeguards to consider:- You cannot represent both the University and the company during contract negotiations.

- Your company should use an external attorney or a representative with no UCR affiliation.

- If you have a financial interest and serve as PI or Co PI, you must disclose it for COI review.

Q: I consult for a company that wants to fund my UCR lab through an industry-sponsored research agreement. Is this allowed?

A: Companies may fund your lab.- If you have a financial interest in the sponsor and are PI or Co PI, the financial interest will require COI disclosure and review before the research can proceed.

-

Intellectual Property and Technology

Q: Can I participate in research sponsored by a company that licensed technology I invented at UCR?

A: Yes, but it may create a research-related conflict of interest if you have a financial interest in the sponsoring company. If you do, you may need to disclose it.

See the State Law column in the UCR COI Disclosure Chart for specific disclosure thresholds.Q: I am an inventor on a university-owned patent. Can I serve as an investigator on research testing its effectiveness?<

A: Possibly. It depends on:- Who is sponsoring the research, and

- Whether you have a financial interest in the sponsor or the research.

If you do have a financial interest, the situation may require review by the COI office.

-

Equity

Q: May I own stock in a publicly traded company and still serve as an investigator on a study of that company’s products?

A: Yes, but depending on the sponsor and the amount or value of your stock, you may be required to disclose this interest and undergo a COI review.

Refer to the UCR COI Disclosure Chart for threshold details.Q: I have equity in a company that wants to fund my UCR lab through an industry-sponsored research agreement. Is this allowed?

A: You may hold equity in the company funding your lab. However, if you are an investigator and your financial interest meets sponsor disclosure thresholds, COI review and approval may be required.

Refer to the UCR COI Disclosure Chart for threshold details.